bain capital tech opportunities fund ii lp

Is a private equity fund operated by Bain Capital Private Equity Lp and has approximately 26 billion in assets. Bain Capital CR LP.

Athenahealth Acquired By Hellman Friedman And Bain Capital Business Wire

Bain Capital Tech Opportunities Fund II LP according to David Lee the director of private equity for the council which manages 34 billion of assets.

. Ad Calverts strategic approach Is built on deep industry-specific research. B Capital Group is a multi-stage global investment firm partnering with extraordinary entrepreneurs. Bain Capital Asia Fund Ii LP.

AMCO partners with business owners and management teams to help recapitalize and grow businesses leveraging deep operational. Company CIK State Incorporated. Ad Our Objective-Based Approach Prioritizes Superior and Repeatable Fund Results.

The New Mexico State Investment Council committed up to 60 million to the vehicle Bain Capital Tech Opportunities Fund II LP according to. Is a private equity fund operated by Bain Capital Private Equity Lp and has approximately 77 billion in assets. Bain Capital which manages more than 100 billion is planning to raise 1 billion for a tech-focused fund that will invest in takeovers.

Bain Capital Credit Ltd. Bain Capital Tech Opportunities pursues investments in application software fintech and payments healthcare IT and infrastructure security. Bain Capital Fund Xi LP.

Scroll up to News. Management has no ownership stake in the fund. We draw upon a senior team with industry venture capital public equity and private equity investing experience.

Bain Capital Tech Opportunities Fund LP. Is one of the larger private funds with. AM Capital Opportunities AMCO with assets under management of approximately 500 million is AMCs lower middle-market growth strategy focused on shared control and structured minority equity investments in North America.

Berger joined Bain Capital Tech Opportunities in 2019. Since our founding in 1984 weve applied our insight and experience to organically expand into. It is not known if the amount raised accounts for Bains commitment.

We combine deep domain expertise with the ability to tap the global reach insight and relationships of the broader Bain Capital platform across the entire technology ecosystem. Bain intended to commit a further 100 million bringing the total to 11 billion. The team combines deep domain expertise with the ability to tap the global reach insight and relationships of the broader Bain Capital platform across the.

Management has no ownership stake in the fund. Beach Point Capital Management LP. See all Bain Capital Locations.

Chart created using amCharts library. Santa Monica CA 90404. Scroll up to Value Creation.

Carta Securities LLC Brown Brothers Harriman Co. Bain Capital Distributors LLC. 0 percent of the fund is owned by fund of funds.

Prior to joining Bain Capital Mr. Bain Capital Tech Opportunities Fund secured 107 billion according to a Form D fundraising document. Bain capital tech opportunities fund ii lp Tuesday February 22 2022 Edit.

Bain Capital Tech Opportunities General Partner LLC. Credit Opportunities II COPs II holds final close. 0 percent of the fund is owned by fund of funds.

The New Mexico State Investment Council committed up to 60 million to the vehicle Bain Capital Tech Opportunities Fund II LP according to. Bain Capital Life Sciences pursues investments in pharmaceutical biotechnology medical device diagnostic and life science tool companies across the globe. Tech Opportunities Fund I closed 11B.

Managing DirectorGeneral Counsel of GP of Issuers GP. Bain Capital is pitching investors on its second technology-focused fund with a goal of raising 15 billion barely a year. The current minimum investment for Bain Capital Fund Xi LP.

Bain Capital Tech Opportunities pursues investments in application software fintech and payments healthcare IT and infrastructure security. Berger was an associate in the Technology Group at General Atlantic in New York where he focused on investing in growth-stage enterprise software and consumer internet businesses. The current minimum investment for Bain Capital Asia Fund Ii LP.

Bain Capital LP is one of the worlds leading private multi-asset alternative investment firms with approximately 160 billion of assets under management that creates lasting impact for our investors teams businesses and the communities in which we live. It is now ahead of its 1 billion target reported last October by Buyouts. Bain Capital is committing 150 million to the fund Mr.

BC Tech Opportunities Private Investors LP. Bain Capital Fund XII LP. You Can Help Clients Balance Risk With Growth Income and Equity-Income Mutual Funds.

Bain Capital LP is one of the worlds leading private multi-asset alternative investment firms with approximately 160 billion of assets under. Bain Capital Fund Xi LP. Earlier in his career he worked in the Financial Sponsors Group at Bank.

The New Mexico State Investment Council committed up to 60 million to the vehicle Bain Capital Tech Opportunities Fund II LP according to David Lee the director of private equity for the council which manages 34 billion of assets for four permanent funds. Managing DirectorGeneral Counsel of GP of Issuers GP. We invest in companies transforming large traditional industries and provide founders with the support they need to scale fast expand into new markets and build exceptional companies.

Bain Capital LPis one of the worlds leading private multi-asset alternative investment firms with approximately 160 billion of assets under management that creates lasting impact for our investors teams businesses and the communities in which we live. Fund 2021 raised 825M MARCH 1987. Bain Capital LP is one of the worlds leading private multi-asset alternative.

Industries Bain Capital Private Equity

Bain Capital Targets 1 5 Billion For Second Tech Opportunities Fund Mint

Bain Capital Launches 560m Crypto Fund Smart Liquidity Research

Bain Capital Hits Target For Tech Fund With Nearly 1 1bn Plans To Keep Raising Buyouts

When I Work Secures 200 Million Growth Investment From Bain Capital Tech Opportunities Bain Capital

Bain Capital Tech Opportunities Crunchbase Investor Profile Investments

Pe Fundraising Scorecard Aea Bain Capital General Atlantic L Squared

Bain Capital Tech Opportunities Crunchbase Investor Profile Investments

Axtria Secures 150 Million Growth Investment From Bain Capital Tech Opportunities

Pitchbook Bain Capital Dec2020 Pdf Equity Securities Investing

Bain Capital S New Technology Fund Makes Maiden Investment Wsj

Our People Bain Capital Tech Opportunities

About Us Bain Capital Private Equity

Our People Bain Capital Tech Opportunities

Axtria Secures 150 Million Growth Investment From Bain Capital Tech Opportunities

Bain Capital Tech Opportunities General Partner Llc

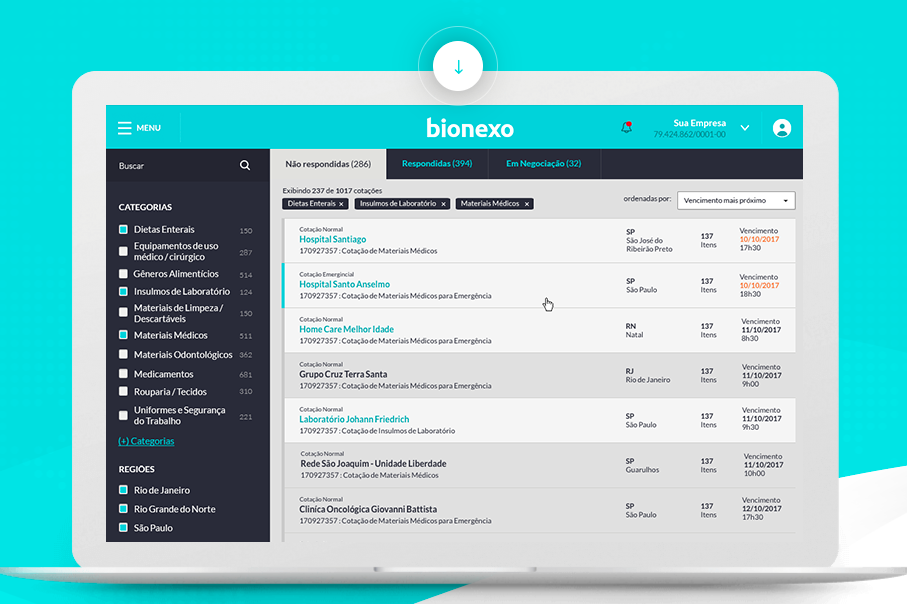

Bionexo Announces R 450 Million Investment From Bain Capital Tech Opportunities Bain Capital

Athenahealth Acquired By Hellman Friedman And Bain Capital Private Equity Insights